In December, I wrote a detailed post on travel insurance and wanted to share my experience on two recent travel insurance claims – one with my credit card’s trip cancelation benefit and the other with travel medical insurance. Overall, I recommend checking the fine print for your credit card travel insurance benefits because I’ve recently found my credit card’s benefits to be the most helpful!

Trip Cancelation Insurance Update

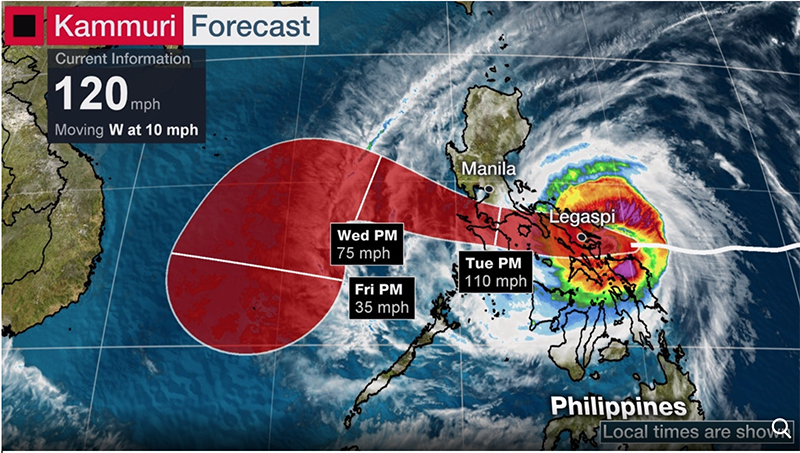

In December, I canceled a trip to the Philippines due to a typhoon. The typhoon hit three days before I was supposed to leave for the trip so I made the executive decision not to go after calling my insurance and the airlines.

I want to be clear that I decided to cancel my flights myself in advance instead of waiting to see if they would be canceled. The news kept talking about landslides and other aftereffects of the storm so I didn’t want to risk it. Plus, I’d booked a four-day sailing trip that would have been miserable with rough seas. It’s no fun snorkeling in murky water!

Since I purchased all my flights on my Chase Sapphire Reserve credit card, I filed a claim through their insurance benefits. (My travel insurance said it would not cover this so I only filed through Chase.) The process was fairly smooth – they required proof of the natural disaster so I sent screenshots and links to news stories about the typhoon. It was the strongest typhoon of the year, and it’s rare for typhoons that late in the season in the Philippines.

They also asked for copies of my billing statement with the flights listed and a copy of the terms and conditions for each flight. I had four flights booked on four different airlines so this was a bit of a nightmare to get all the paperwork together. You have to prove that the airlines will not refund you portion of the airfare before they will pay the claim. Two of the airlines said they would refund me a small portion of the airfare ($20 for one airline; $26.50 for the other). Since these airlines had a partial refund policy, it took 30 days for the refund to show up on my credit card. I had to submit proof of this partial refund before the claim would be paid. This was the most annoying and tedious part since I had to submit documents for the different airlines. I also had to contact each of these airlines individually to cancel the flights and get the required documents. It took about 6-7 weeks total from the date I canceled the flight until the claim was paid because I had to wait for the partial refunds to show up on my credit card statement. Once I submitted the final documents, it only took a few days for the claim to be approved and another few days for the direct deposit to appear after I entered my banking details.

Overall, the paperwork was a bit tedious but the processing itself was fast after the paperwork was submitted. They reviewed the documents within 48 hours of receiving them and then, I got an email update. I did have to call a few times to clarify details. (Ironically, my credit card number was stolen during this process so I had a new card number so I had to clarify this, etc.) I’d totally recommend using this Chase credit card insurance in the future. I recommend checking with your credit card to see if they offer this service and be sure to pay for your entire trip on the same card to make the most of this benefit.

Chase also has excellent rental car coverage while abroad so I always decline the rental companies coverage, which saves a ton of money. (U.S. car insurance will not cover you abroad aside from a few miles in Mexico or Canada.) You have to pay in full for the rental car with your card for it to be covered.

IM Global Insurance Review

I’ve used this company for my travel insurance for years because it’s affordable and my old job used to buy it for all employees. They always paid claims or processed them within 30 days of filing until recently. I submitted two claims in December. It’s been almost two months since the first claim and I’ve yet to get a response either way. It took them three months to respond to a claim I made last year about a dental issue. (I thought the delay was the nature of the claim since dental coverage is tricky, but it seems like they are terrible at processing any type of claim on time now. While this is the cheapest coverage I’ve found with $0 deductible and a lot of customizable options, I’m hesitate to recommend it. Thankfully, I was able to pay for my claims in full without any financial strain. I can’t imagine how frustrating it would be to have put these medical expenses on a credit card and get no response for months! For short trips, I’d recommend World Nomads, Safety Wing or credit card insurance benefits instead of IM Global at this point. For long-term coverage, I’d only recommend it if you had enough savings to cover a medical issue and wait for the claim processing.

UPDATE: IM GLOBAL paid my claim dated 12/16/19 on 4/22/20. I’ve still got two outstanding claims but the first one was paid but FOUR months after filing. This claim was only $45 so I’m still waiting on the larger claims. If they deny me, I will appeal forever. 🙂

Coronavirus & Cancel for Any Reason Insurance

AFAR had a great article that came out recently about Cancel for Any Reason Insurance. This is an option available with some insurance plans. It’s pricey and costs about 5-10% of the overall trip cost. For this type of coverage to work, the policy needs to be purchased before an event like a typhoon or winter storm is a known event.

It’s really important to note that insurance will most likely NOT cover you when visiting a place where a travel ban has been put in place. (Americans should check travel.state.gov for travel warnings.) If you have concerns, contact the insurance agency to ask if your location will be covered before booking the trip or purchasing the policy. In the past, destinations with ebola outbreaks were not covered by policies once it was a known event. Keep all of this in mind as Coronavirus seems to be an increasing concern.

I was just in Southeast Asia for work but thankfully, I was NOT in an area exposed to the virus. As an extra precaution, I wore masks on the planes only to keep myself from touching my face. Most masks are pointless, but it’s important not to touch your face. Be sure to wipe down your seat on the plane with Clorox wipes – tray table, seat belt, etc. This is just a good practice in general because let’s be honest – they probably NEVER wipe down those tray tables EVER!

For more about travel insurance, check out my Travel Insurance 101 post!